Estate planning isn’t just about who gets what—it’s about how your assets are passed down and whether the asset distributions remain within each family branch or whether they are divided equally among the living family members without considering lineage differences. Two important terms that can significantly affect how your estate is distributed are “per stirpes” and “per capita.”

The interpretations of these legal terms can vary based on state laws and the language contained in a Will, Trust, or beneficiary designation on a specific account. Below is a general overview of what these two legal terms mean in most instances. In some cases, the terms result in the same distribution, while at other times, a very different result is achieved.

Per Stirpes: “By Branch”

The Latin term per stirpes means “by branch.” It also referred to as “by representation.” This distribution method ensures that if a named beneficiary (like a child) passes away before you, their share doesn’t vanish—it goes directly to their descendants.

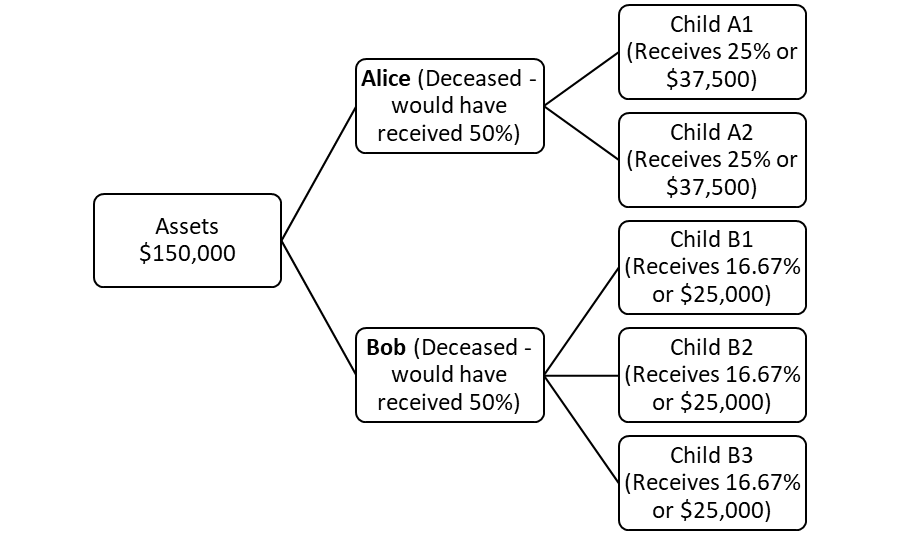

Per Stirpes Example

Let’s say you have two children—Alice and Bob—and each of them has a different number of grandchildren. If Alice and Bob both die before you, his 50% share would be equally divided among their then living children. i.e. the inheritance stays within the “branch” of the family. See below for illustration purposes.

Per Capita: “By Head”

The Latin term per capita translates to “by head.” With this distribution method, living beneficiaries at the same generational level receive an equal share.

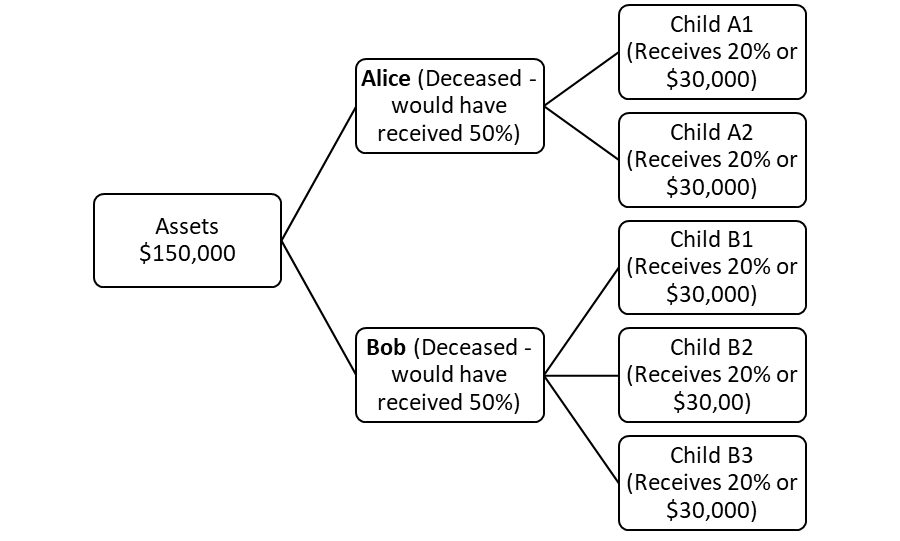

Per Capita Example

Using the same family as above, note below the different distribution at the grandchildren level.

Choosing the Right Method

Your decision between per stirpes and per capita should reflect your family structure and personal values:

Final Thoughts

These terms are not interchangeable—they may result in very different distributions, particularly if a beneficiary predeceases you. Understanding the difference between per stirpes and per capita is a small but vital part of crafting an estate plan that honors your intentions. Take the time to clarify how you want your legacy to be distributed—it can provide clarity, reduce disputes, and bring peace of mind to those you care about most.